- Lending practices during crisis can quickly become a huge increase in risk

- AI helps you analyze all of the data available to determine which sectors are too risky to continue lending to

- You can decrease your risk portfolio going forward

- And identify in which sectors new business needs be curated

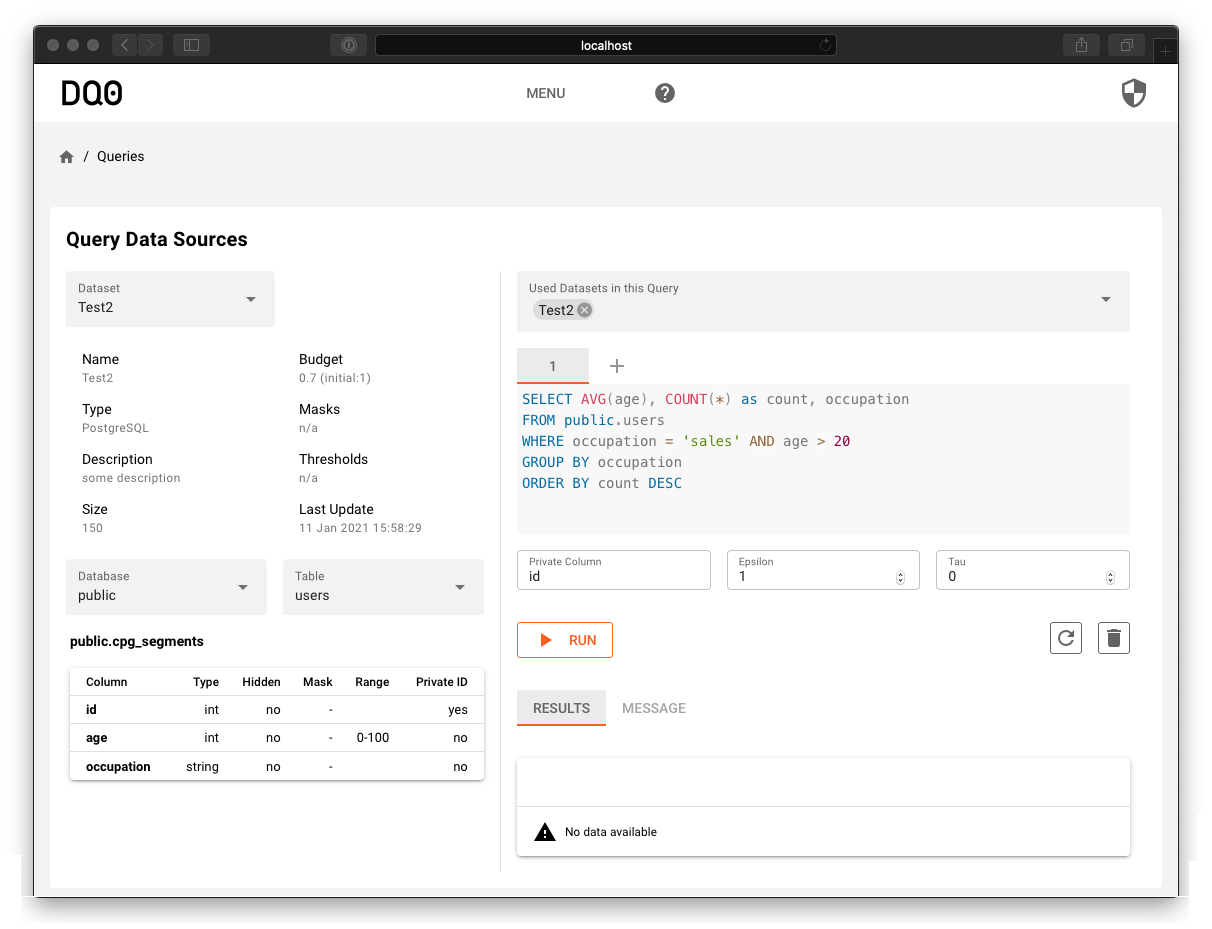

DQ0 Data Science Dashboard

DQ0 Data Science Dashboard

Use AI to track irregularities in lending practices in order to decrease the risk of your bank.

And make the most of the data available to you, by employing differential privacy to protect the privacy of your customers - ensuring you can get the most accurate recommendations while staying fully GDPR compliant.